As a hub for international trade, the Middle East offers immense opportunities offers exporters a dynamic and profitable market. To succeed, exporters must thoroughly understand the regulations, required paperwork, and approval processes. This article delves into the specifics of exporting to the Middle East, emphasizing the Gulf Cooperation Council (GCC) countries.

Getting Ready for Export Success

Trade with the Middle East requires more than just shipping know-how. Success requires mastering regional regulations, cultural nuances, and approval protocols. With each country enforcing distinct rules, thorough planning is essential.

Essential Paperwork for GCC Trade

While specifics vary by nation, many documents are universally necessary:

1. Commercial Invoice: Listing the goods, their value, and the sales terms, this document is crucial. Correctness is essential to avoid delays.

2. Cargo Contents List: This document details the size, weight, and contents of each package.

3. Proof of Origin Document: Essential for verifying where products originate, as required by importing nations.

4. Transport Agreement: An agreement between shipper and copyright outlining the goods’ transport.

5. Import Authorization: Mandatory for restricted or controlled product categories.

6. Meeting Standards and Guidelines: Conforming to local technical norms is non-negotiable for entry.

Navigating Local Agencies for Smooth Trade

Various agencies oversee import regulations in GCC countries. Here are the major regulatory entities for each GCC nation:

Saudi Arabia

Saudi Arabia, being the largest economy in the GCC, maintains rigorous import controls.

• Oversight by the SFDA: Regulates sensitive imports like food and medical products.

• Saudi Standards, Metrology, and Quality Organization (SASO): Imposes Certificate of Conformity (CoC) requirements for specific goods.

• Customs Clearance in Saudi Arabia: Handles customs clearance with stringent documentation checks.

Trade in the UAE

As a global trade hub, the UAE combines streamlined processes with detailed regulatory requirements.

• Dubai’s Regulatory Framework: Regulates imports of food, cosmetics, and certain chemicals.

• Oversight by MOCCAE: Monitors agricultural goods and environmental compliance.

• Customs Processes in the UAE: Streamlines customs declarations through digital platforms.

Qatar

Compliance with Qatar’s trade policies is essential for market entry.

• Qatar’s Trade Ministry Guidelines: Handles trade policies and product registration.

• QS and Product Standards: Requires documentation of product conformity.

• Qatar Customs Clearance: Facilitates the entry of certified goods.

Trade Opportunities in Bahrain

Exporting to Bahrain requires understanding its simplified trade landscape.

• Customs Authority of Bahrain: Simplifies trade with e-government solutions.

• Bahrain’s Trade Regulatory Body: Focuses on promoting safta certificate of origin business-friendly policies.

• BSMD’s Role in Trade: Coordinates with GCC-wide regulatory initiatives.

Navigating Kuwait’s Trade Requirements

Exporters must meet Kuwait’s stringent product standards.

• Kuwait General Administration of Customs: Implements strict import documentation reviews.

• PAI and Product Standards: Certifies goods against national standards.

• Ministry of Commerce and Industry (MOCI): Monitors compliance with Kuwait’s trade laws.

Oman

To import goods into Oman, the following steps are involved:

• The Ministry of Commerce, Industry, and Investment Promotion ensures adherence to local trade standards.

• DGSM is responsible for conformity evaluations and technical regulations.

• Customs clearance is handled by the Royal Oman Police Customs Directorate, which mandates precise documentation.

Important Considerations for Exporting to Specific Countries

Packaging and Labeling Requirements

Each GCC country has specific labeling and packaging requirements:

• Arabic is required on all labels, but bilingual labels in Arabic and English are often advantageous.

• Content: Labels must include the product name, origin, ingredients, expiration date, and any safety warnings.

• Packaging: Must meet local environmental regulations, such as biodegradable packaging in Saudi Arabia.

Items Subject to Restrictions or Bans

Certain items are not allowed or subject to strict controls in the GCC:

• Products offensive to Islamic values are prohibited.

• Alcohol and Pork: Strictly controlled or prohibited in many GCC countries.

• Chemicals and pharmaceuticals need specific authorizations.

Tariffs and Duties

Most GCC countries adhere to the GCC Customs Union’s unified tariff structure, imposing 5% on most imports. However, exceptions apply for specific items, such as luxury goods or agricultural products.

Key Challenges in Exporting to the Middle East

1. Cultural Nuances: Understanding and respecting local customs and business etiquette is crucial.

2. Regulatory Complexity: Each country’s unique requirements necessitate meticulous planning.

3. Mistakes in documentation may cause substantial hold-ups.

4. Keeping up with changing regulations in the GCC is essential.

Strategies for Effective Exporting

1. Working with local representatives helps ease compliance challenges.

2. Leverage Free Zones: Many GCC countries offer free trade zones with relaxed regulations and tax incentives.

3. Leverage digital tools like FASAH in Saudi Arabia and UAE e-Services for efficient trade management.

4. Consult trade professionals or forwarders for smooth navigation of intricate processes.

Wrapping Up

Entering the GCC market offers vast opportunities but requires detailed planning and awareness of regional specifics.

By focusing on accurate documentation, adhering to local standards, and leveraging available resources, exporters can unlock the potential of this dynamic region.

With a well-thought-out strategy and thorough execution, companies can succeed in the Middle East.

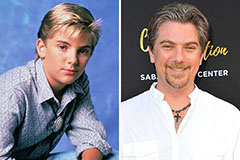

Jonathan Lipnicki Then & Now!

Jonathan Lipnicki Then & Now! Jeremy Miller Then & Now!

Jeremy Miller Then & Now! Marcus Jordan Then & Now!

Marcus Jordan Then & Now! Robbie Rist Then & Now!

Robbie Rist Then & Now! Pauley Perrette Then & Now!

Pauley Perrette Then & Now!